Challenge:

Banks and Financial institutions are embracing technology to stay completive in the digital world. They want faster-cheaper-better solutions to retain customers and win new businesses.

User Experience as a core pillar for digital transformation strategy was key to making banking succeed in a tough competitive landscape to stay ahead of the digital curve.

Digital Transformation Strategy:

A holistic 360 degree strategy was adopted to modernize existing platforms from monolithic to micro services driven architectures and providing delightful experiences to end users and banking staff.

The strategies included:

- Defining right goals for all categories of persona’s

- Practicing financial philosophy by creating empathy maps, mood boards, conducting ethnography and deep user studies.

- Taking holistic UX approach. A user centered design methodology was implemented at every stage to create solutions that easy to use and delightful

- Making products more personalized

- Usability testing techniques like validation of A/B concepts, KANO and BERT analysis helped improve SUS scores and overall NPS.

Solutions

Cards business which includes Debit, Credit Gift and Risks desperately needed an overhaul on both consumer and FI facing application modernizations. Here are couple of examples of digital transformations.

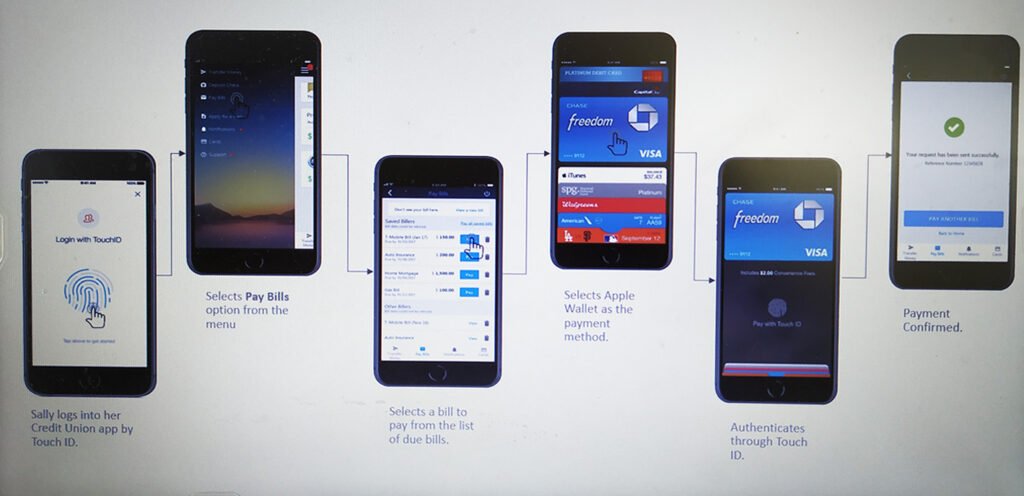

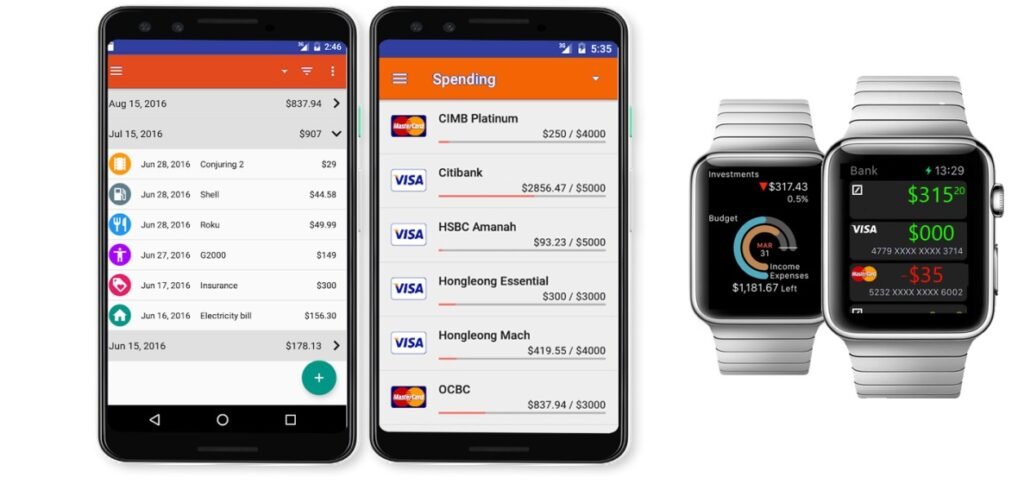

Consumers: Required to manage their cards, alerts notification, usage limits in form of easy to use app and effectively handle payments through digital wallet.

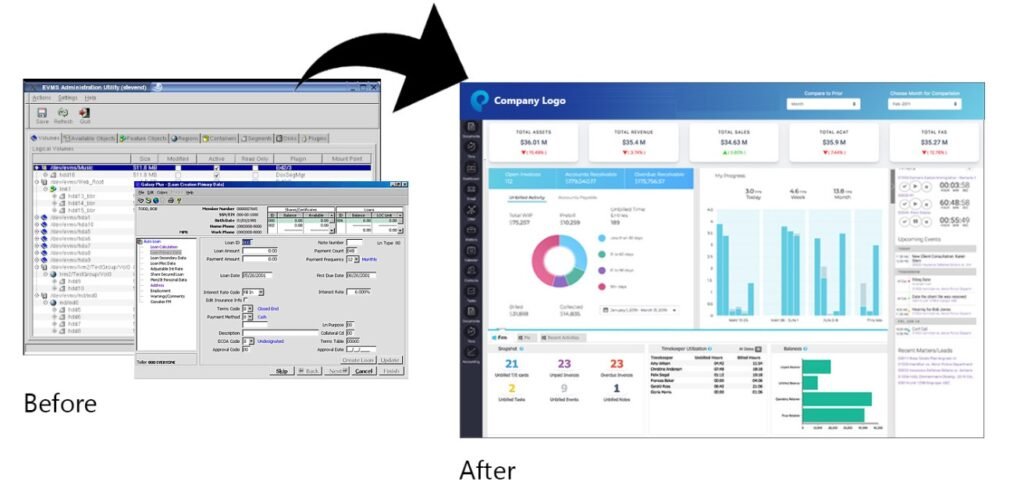

Institutional cards management: FI’s required up gradation of their backend system to handle all kinds of scenarios from issuing to dispute management and contact center handling. New products were conceptualized like credit console, product catalog service manager, disputes resolve, and the whole mainframe based applications were upgraded to UI wrapper based software.

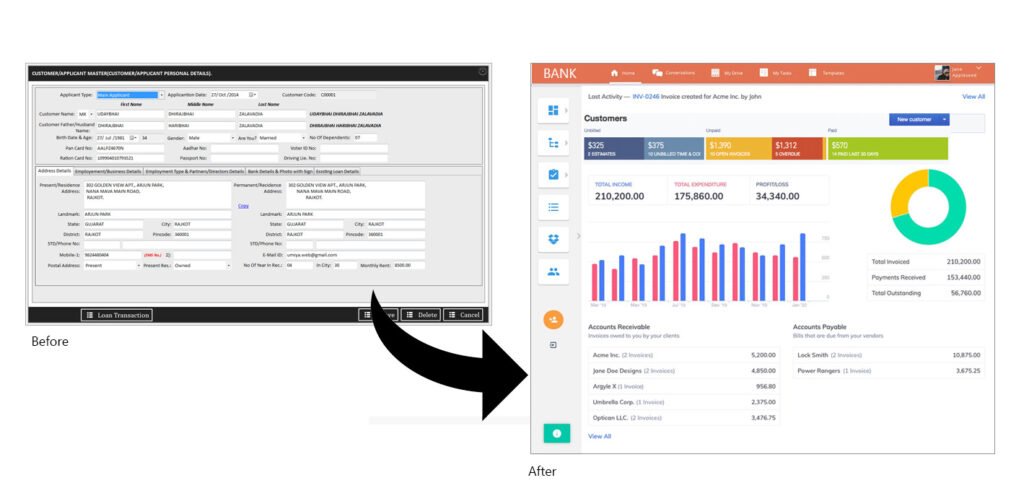

Core Banking experience made easier and faster.

- Personalized workflows and user-level customization that promote productivity, using navigation based on work processes to eliminate repetitive searches

- Favorites that promote efficient, one-click navigation for most frequent tasks

- A complete view of customer relationships

- Robust reporting and efficient access to reports and images

- Advanced customer relationship management, analysis and reporting tools

Unparalleled integration to many valuable add-on solutions, including e-commerce, business intelligence, deposit capture and imaging, branch automation, rewards, and risk and compliance solutions. Business continuity, education and other professional services are also available

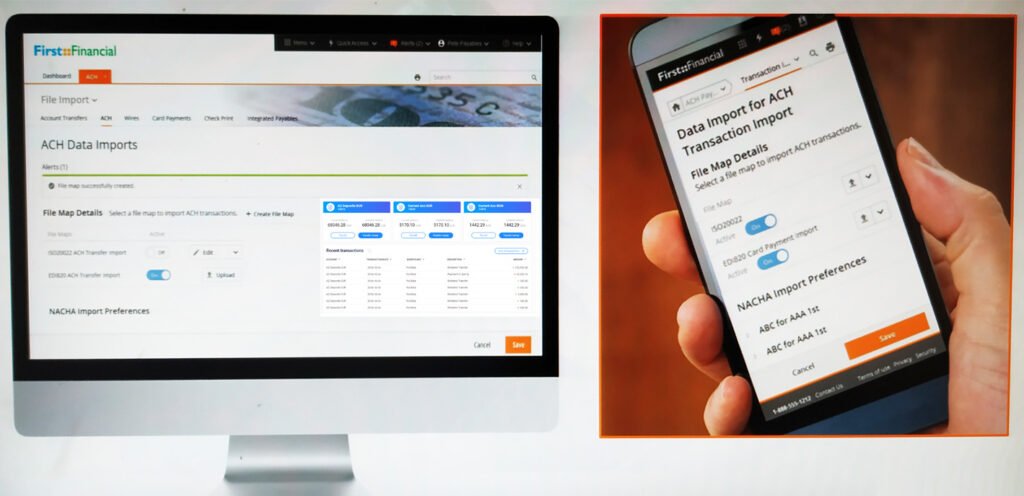

Corporate and Commercial Banking

End-to-end experience with white label suite of products that combines ease of use with the sophisticated capabilities business customers need.

- Commercial Center: Corporate. This e-banking and business services portal leverages modular services, data transformation and multiple delivery and accesses channels to create a highly flexible platform

- Commercial Center: Small Business. A powerful yet simple set of online banking tools to help financial institutions grow adoption, loyalty and revenue from the increasingly strong small business and business banking market segment

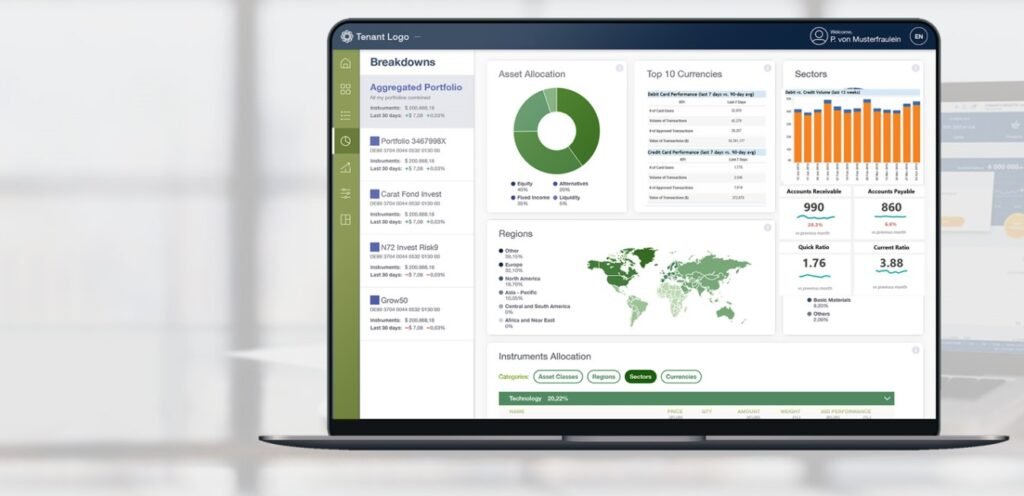

Wealth management Platform:

The Unified Wealth Platform from Fiserv represents the integration of our front-, middle- and back-office wealth management technology, which can be leveraged in total by large enterprises.

- Financial Advice Management: Goals-based financial and investment advisory tools, including: basic, intermediate and advanced financial planning modules, CashEdge data aggregation, Morningstar analytics and asset allocation, proposal generation tools, retirement income analysis, asset location optimization and Monte Carlo simulations

- Portfolio Management, Accounting and Trading: A multi-vehicle and multi-asset class portfolio accounting system with related trading, tax management and rebalancing tools for all fee-based advisory programs, including: separately managed accounts (SMAs), mutual fund advisory (MFA), rep as manager (RPM), rep as advisor (RPA) and unified managed accounts (UMAs)

- Performance and Portfolio Reporting: Offers advisor, home office, and end investor performance reporting and monitoring services through Web-based tools with advanced business intelligence

- Billing Services: Automation in fee billing and revenue management

Model Management: Technology designed to automate the management of model portfolios, which can eliminate manual steps and human error and increase investment strategy options for your clients and your firm’s capacity to grow its managed account business

FI invoicing Management Platform:

comprehensive customer billing and revenue management solution, which helps financial services organizations worldwide to support flexible, highly complex and fast-changing fee structures with efficient, controlled invoicing.

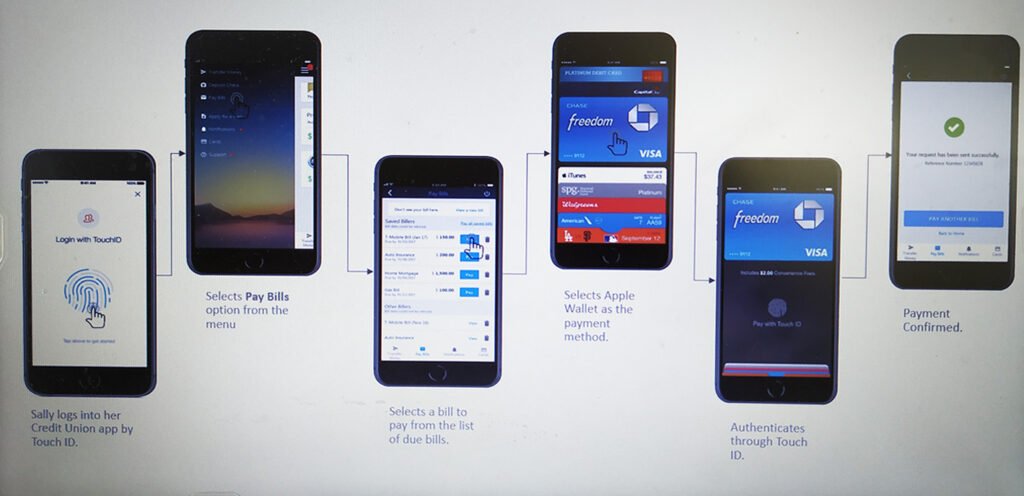

Mobile Digital Channels and Payments:

With mobile banking, alerting, database access, workflow, and payments solutions, perfect for banks and credit unions of all sizes.

- The broadest range of mobile transactions, from simple banking inquiries to a complete set of mobile alerting and payment models, satisfying the needs of every customer segment

- Simultaneous support of all three mobile access modes – SMS, mobile browser and downloadable application – through a single integrated platform

- The most comprehensive enrollment and customer care tools and reporting across both the online and mobile channels

- Enterprise-grade channel management capabilities, including service analytics, security management, diagnostic resources and tools that facilitate full integration into the financial institution’s core infrastructure assets

- Fully integrated mobile deposit

- Mobile access to your enterprise content management to electronically review and approve documents